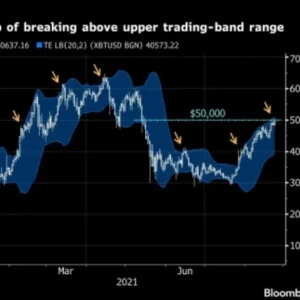

In a significant milestone, Bitcoin surged past the $50,000 mark on Tuesday, February 13th, 2024, for the first time since December 2021. This rally represents a major comeback for the cryptocurrency, following a tumultuous period marked by volatility and price drops.

Several factors appear to be fueling the current upswing. The recent approval of spot Bitcoin exchange-traded funds (ETFs) in the US is seen as a key driver, offering mainstream investors easier access to the asset. This has injected renewed confidence into the market, attracting both retail and institutional players.

Furthermore, Bitcoin's recent performance has been bolstered by positive sentiment, with many viewing the $50,000 level as a crucial psychological barrier. Crossing this threshold has instilled optimism amongst bulls, potentially encouraging further buying pressure.

Analysts point to other contributing factors as well. Increased global economic uncertainty and inflation concerns continue to push some investors towards alternative assets like Bitcoin, perceived as a hedge against traditional financial systems. Additionally, the diminishing selling pressure from miners and Grayscale's Bitcoin Trust is contributing to price stability.

However, it's crucial to acknowledge the inherent volatility associated with Bitcoin and the cryptocurrency market in general. While the current rally is encouraging, future price movements remain unpredictable. Experts caution against excessive bullishness and recommend responsible investment strategies.

The significance of this $50,000 breach extends beyond mere price movement. It reflects a potential resurgence of interest in Bitcoin and the wider crypto market. Whether this translates into sustained growth or another period of correction remains to be seen. However, it undoubtedly marks a crucial turning point in Bitcoin's recent history.