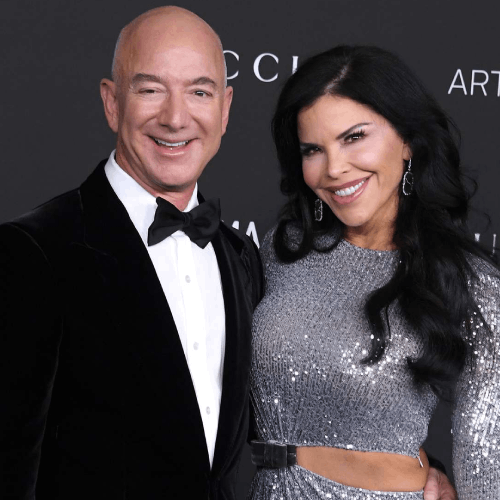

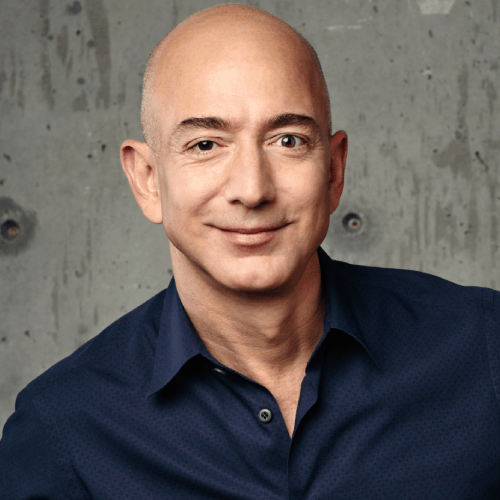

Jeff Bezos, the e-commerce giant's founder and former CEO, announced plans to sell up to 50 million Amazon shares, potentially cashing in on $8.6 billion based on current market prices. This move, while substantial, isn't entirely unexpected, but it raises questions about Bezos's future plans and potential implications for Amazon.

Unpacking the Sale:

The sale plan was pre-arranged in November 2023 and must be completed by January 31, 2025. The exact number of shares sold will depend on market conditions and other factors. This isn't Bezos's first significant stock sale; he has divested billions in recent years, primarily to fund Blue Origin, his space exploration company.

Possible Motivations:

Several possible reasons exist for this latest sale:

- Diversification: Bezos might be diversifying his wealth beyond Amazon. With a net worth currently hovering around $185 billion, reducing his Amazon stake could spread his risk and open up investment opportunities in other sectors.

- Funding Blue Origin: Blue Origin continues its ambitious spacefaring pursuits, requiring hefty investments. This sale could inject more capital into the venture.

- Personal Philanthropy: Bezos is known for his philanthropic endeavors, and the proceeds from the sale could be used to further his charitable giving.

- Tax Planning: Selling shares before January 31st ensures capital gains taxes are based on current lower rates, avoiding potential future increases.

Impact on Amazon:

The sale's immediate impact on Amazon's stock price might be minimal, considering Bezos still owns a significant stake (around 10% after the sale). However, it could signal reduced confidence in the company's future growth potential to some investors. Additionally, losing such a prominent figurehead might affect employee morale and public perception.

Looking Ahead:

While the precise reasons behind the sale remain unknown, it undoubtedly marks a significant shift for Bezos and potentially Amazon. As he focuses on other ventures, questions arise about who will steer the e-commerce behemoth in the future and how it will navigate the increasingly competitive tech landscape. Only time will tell how this move unfolds and its lasting impact on both Bezos and his empire.

This article provides a concise overview of Bezos's stock sale, exploring potential motivations and implications. Remember, this is just one perspective, and further analysis and updates are likely as the story develops.